rhode island income tax nexus

August 17 2017 register or comply with notice through June 30 2019. Members 1 2 and 3 have corporate income tax nexus with Rhode Island and engage in activities that exceed the protection of Public Law 86-272.

Rhode Island Rules Modify Nexus for Coronavirus.

. Establishing Nexus In general terms nexus means that a business has sufficient connection or presence in RI for the state to have taxing authority. Whether an employee is subject to Rhode Island income tax withholding is. The purpose of this regulation is to implement Rhode Island General Laws RIGL Sections 44-11-4 and 44-11-41.

You will need a completed Business Application and Registration Form along with the 10 fee. For the duration of Rhode Islands COVID-19 state of emergency the Department will not seek to establish nexus for Rhode Island corporate income tax purposes solely because an employee is temporarily working from home during the state of emergency or because an employee is temporarily working from home during the state of emergency and is using property to allow. Gross revenue equal to or exceeding 100000 or 200 or more separate transactions.

Rhode Island Tax Nexus. Income tax nexus with Rhode Island. For the duration of the states coronavirus state of emergency the DOT will not seek to establish nexus for sales and use or corporate income tax purposes solely because an employee is temporarily working from home.

To get to your refund status youll need the following information as shown on your return. RI Division of Taxation. Please contact us with any additional questions via email taxregistrationtaxrigov or by phone 4015748938.

This Rule describes activities that are sufficient for creating corporate income tax nexus between the State of Rhode Island and a foreign corporation. 5 See among other things Rhode Island Division of Taxation Regulation 280-RICR-20-25-8 Nexus. The Rhode Island Division of Taxation DOT has provided guidance regarding nexus creation due to telework during the COVID-19 pandemic.

Member 4 does not have corporate income tax nexus with Rhode Island. Coronavirus COVID-19 Pandemic Employees telecommuting during the health emergency does not create nexus alter the apportionment formula or require additional withholding. A foreign entity is subject to RI tax if it conducts business in RI and has income apportionable to RI.

Corporations M N and O all foreign corporations are engaged in a unitary business and are members in the same combined group. Establishing nexus generally means that a business has sufficient connection or presence in rhode island for the state to have taxing authority. May 26 2020 103 PM.

July 1 2019 mandatory registration. Up to 10 cash back Employees telecommuting during the health emergency does not create nexus or alter the apportionment formula. Member 3 is the combined groups designated agent.

4 United States Public Law 86-272 codified at 15 US. Business Corporation Tax Apportionment of Net Income Regulation CT 15-04 CT 15-04 makes changes to corporate tax reporting along the lines of the rules adopted for years 2009. Rhode island income tax nexus.

Regulation CT 15-02 Corporate Nexus replaces Regulation CT 95-02 Nexus for Business Corporation Tax. Section 280-RICR-20-25-810 - Activities that Create Nexus A. Rhode Island Enacts Economic Nexus and Reporting Requirements Provisions.

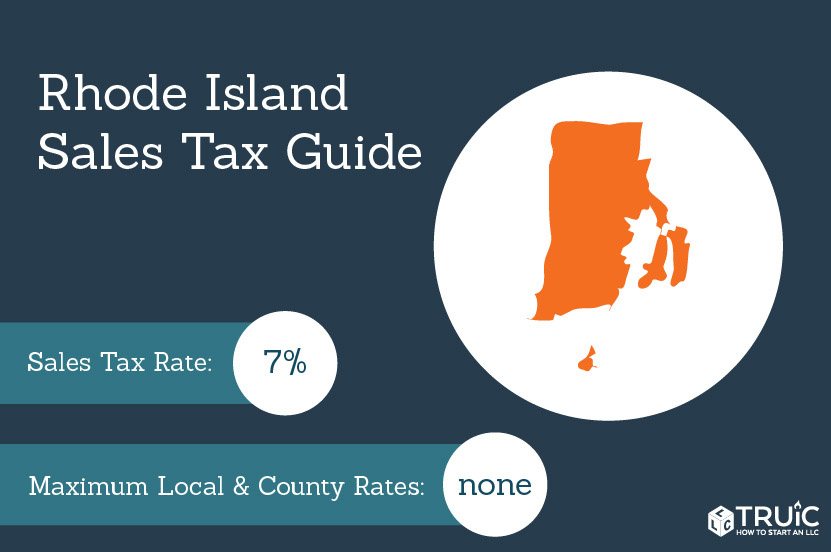

One of the more complicated aspects of Rhode Island sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of Rhode Island and is thus subject to state and possibly local sales taxes. This amendment provides guidance regarding Nexus for Business Corporation Tax. Please note that for applications for new businesses beginning on or.

The income tax is progressive tax with rates ranging from 375 up to 599. Generally a business has nexus in Rhode Island when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Go to our Registration page for registration options and additional information. Whether an employee is subject to Rhode Island withholding is not to change while employees are working from home. If a vendors transactions are determined to have nexus in Rhode Island the vendor must register for a Rhode Island sales.

Code 381 et seq. There is also a change in style and format. Your social security number.

The intersection of tax withholding remote work and locality tax rules can be seen in high-profile incidents such as a 2020 dispute between Massachusetts and New Hampshire over nonresident taxation. The emergency regulations apply to wages earned starting March 9. For the duration of Rhode Islands coronavirus state of emergency the Division of Taxation will not seek to establish nexus for Rhode Island corporate income tax purposes solely because an employee is temporarily working from home during the state of emergency or because an employee is temporarily working from home during the state of emergency and is.

Only Corporation M has nexus with Rhode Island. As the combined groups designated agent Member 3 must file a combined return. Please provide the information below.

The combined group of Corporations M N and O must file a combined report with Rhode Island. Access this secure Web site to find out if the Division of Taxation received your return and whether your refund was processed. Locality tax and telecommuters.

The activities enumerated in this Rule below are. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. For help determining if you have nexus in Rhode Island please review the Managed Audit Nexus Questionnaire found on the Audit Forms page.

Note that this policy is predicated on the condition that the company would not otherwise have nexus due to physical presence or economic nexus in rhode island. Businesses with nexus in Rhode Island are required to register with the Rhode Island Department of Taxation and to charge collect and remit the appropriate tax. Massachusetts issued guidance temporarily superseding its existing laws to the.

Business Corporation Tax Corporate Nexus Regulation CT 15-02 CT 15-02 provides enhanced guidance about which activities make a foreign corporate entity subject to Rhode Island income tax. 3 Rhode Islands corporate income tax is also known as the business corporation tax see Rhode Island General Laws Chapter 44-11.

Rhode Island State Strategies To Enroll Justice Involved Individuals In Health Coverage The National Academy For State Health Policy

Rhode Island Sales Tax Nexus Laws

Focus On Rhode Island Miles Consulting Group

How To Register For A Sales Tax Permit In Rhode Island Taxvalet

How To File And Pay Sales Tax In Rhode Island Taxvalet

Covid 19 Information Ri Division Of Taxation

State Local Tax Impacts Of Covid 19 For Rhode Island 2020 Bkd

How To File And Pay Sales Tax In Rhode Island Taxvalet

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Analyzes Two Year Study Considers Combined Reporting

How To File And Pay Sales Tax In Rhode Island Taxvalet

Business Guide To Sales Tax In Rhode Island

David P 1990 The Dynamo And The Computer An Historical Perspective On The Modern Productivity Parado Paradox Human Development Report Development Programs